Sales Tax In Texas 2025. Stay compliant in 2025 with our guide on sales tax trends, including regulatory changes, nexus determination, and how to automate your calculations and collections. While texas doesn’t have an individual income tax, it does have a state sales and use tax on goods and services.

Sales tax rates, remote seller nexus rules, tax holidays, amnesty programs, and legislative updates. The sales tax effective date for.

Texas Sales Tax Free Weekend 2025 Rebecca Stewarts, What we’ve shared here are just a few of the changes likely to impact sales tax compliance in 2025.

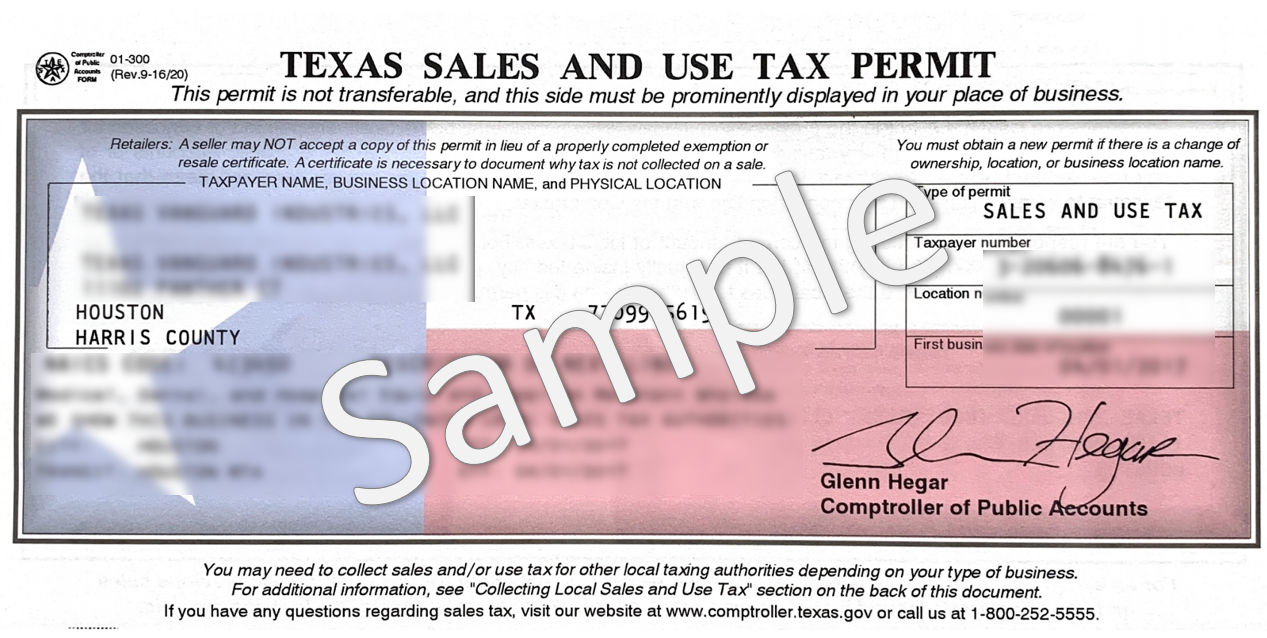

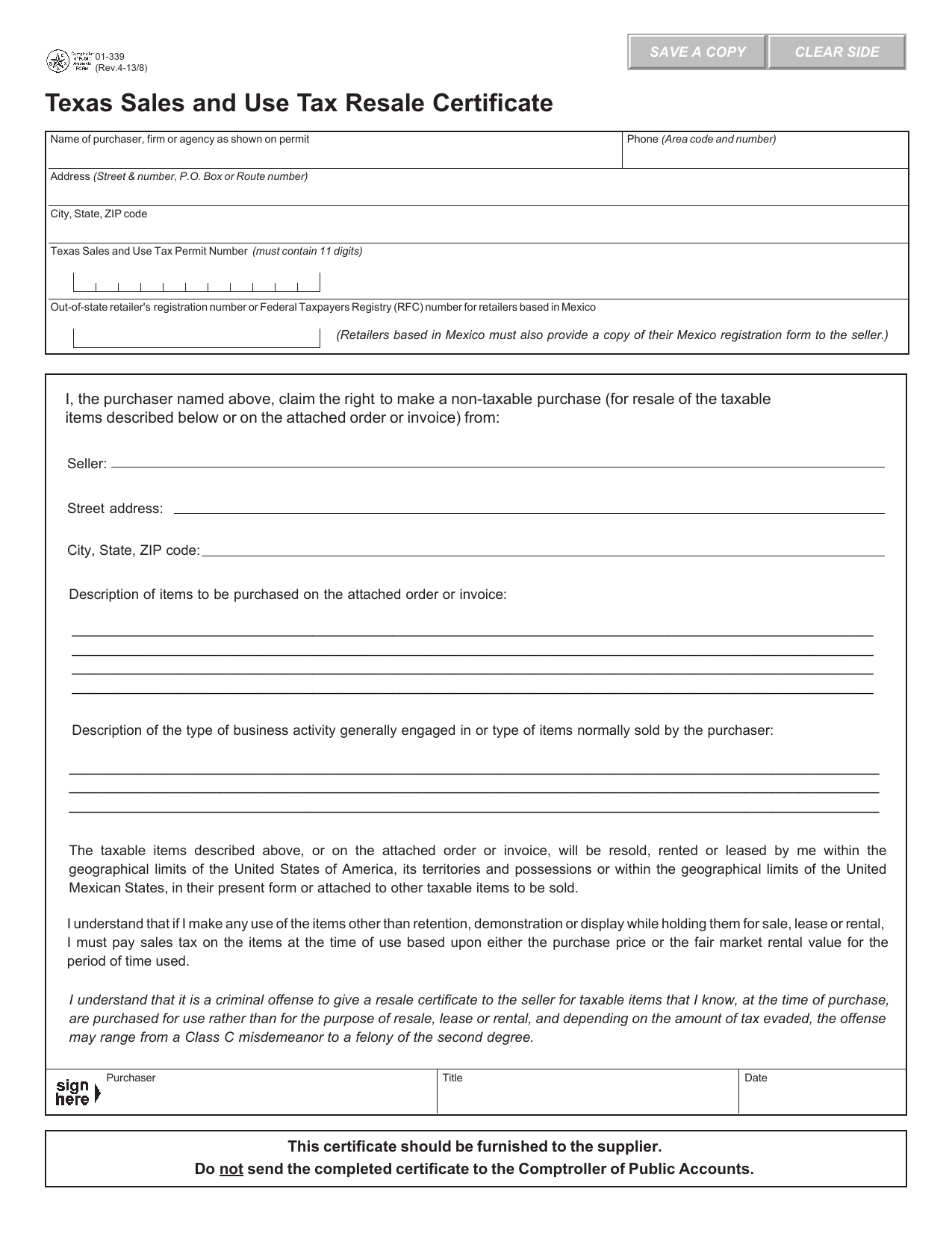

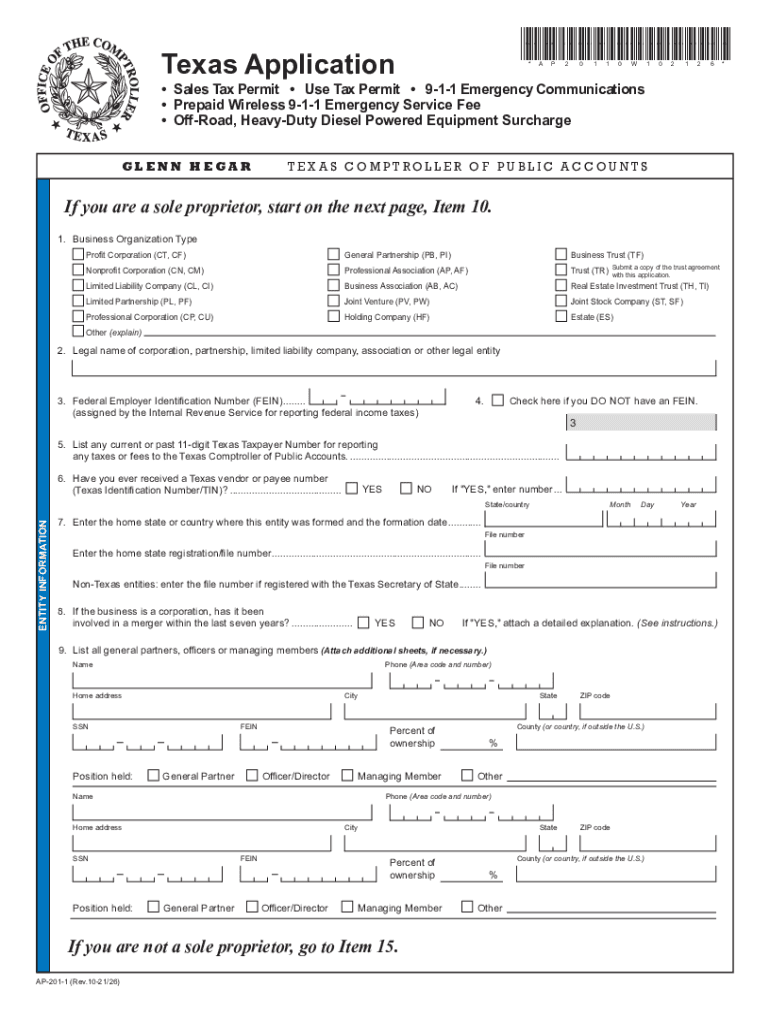

Texas Sales And Use Tax Exemption Certification 01339 Form, This page outlines the key tax deadlines.

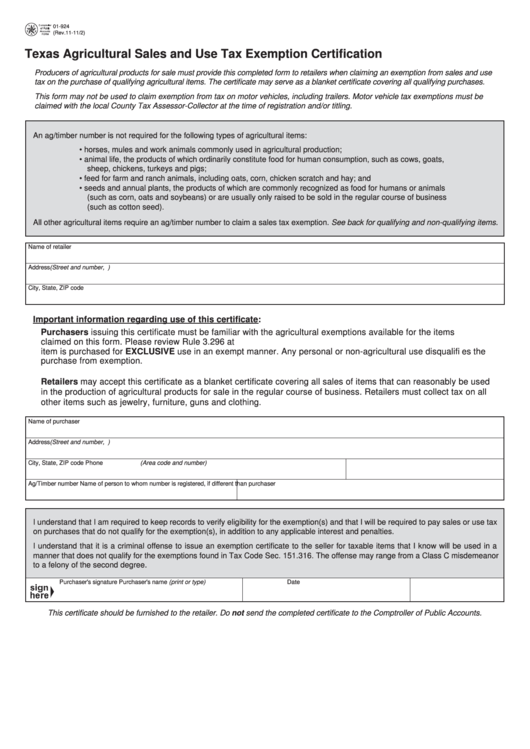

Farm Sales Tax Exemption Form Texas, Stay compliant in 2025 with our guide on sales tax trends, including regulatory changes, nexus determination, and how to automate your calculations and collections.

Sales Tax Calculator 2025 Texas Neil King, The texas sales tax rate is 6.25% as of 2025, with some cities and counties adding a local sales tax on top of the tx state sales tax.

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes, The annual salary calculator is updated with the latest income tax rates in texas for 2025 and is a great calculator for working out your income.

File Texas Sales Tax, Washington extends reduced business and occupation tax rate and sales and use tax exemption for semiconductor.

Texas Sales Tax Free Weekend 2025 Rebecca Stewarts, Texas does not impose a state income tax on individuals.

Where Is Shepard Smith 2025. The program will air monday through friday at 7 p.m., and bears a title similar to the msnbc and cnbc. Microsoft announced last week that

Gmc Trucks 2025. Our filter options help you find the best gmc model based on your selected criteria. The new sierra ev comes in two flavors: This impending release is

2025 Book Releases. Great big beautiful life by emily henry, sunrise on the reaping by suzanne collins, onyx storm by rebecca yarros, deep en. Audition releases on april 8, and